Top Nigerian Banks Featured in the Ranking

Nigeria has once again reinforced its status as a financial powerhouse in Africa as several of its top banks secured leading positions in the newly released “Africa’s 300 Finance Champions” ranking by The Africa Report. The 2025 edition of the ranking highlights the strength, stability, and growing influence of Nigerian financial institutions across the continent.

The list evaluates banks based on strict indicators such as profitability, asset size, liquidity, solvency, and credit quality. Nigeria’s major banks stood out, earning top spots thanks to their strong financial performance and expanding regional footprints.

Top Nigerian Banks Featured in the Ranking

According to the report, five of Nigeria’s biggest banks made it into the top tier:

1. Guaranty Trust Bank (GTBank) – Rank #1

GTBank emerged as the number one banking group in Africa, securing the highest score in profitability and operational efficiency. The bank’s consistent performance and robust risk management helped it outperform its continental peers.

2. Zenith Bank – Rank #3

Zenith Bank claimed the third position, recognized for its solid balance sheet, excellent liquidity, and continuous growth within and outside Nigeria.

3. United Bank for Africa (UBA) – Rank #5

UBA, known for its strong pan-African presence, ranked fifth overall. Operating in over 20 African countries, the bank continues to expand its customer base and digital financial solutions.

4. Access Bank – Rank #9

Access Bank, one of Africa’s fastest-growing institutions, secured the 9th position. Its massive asset base and aggressive regional expansion strategy played a key role in boosting its ranking.

5. First Bank of Nigeria – Rank #12

First Bank maintained its reputation as one of Africa’s most enduring financial institutions, ranking 12th with impressive scores in solvency and credit strength.

Why Nigerian Banks Dominated the Ranking

-

Strong Asset Growth

Banks like Access Bank and Zenith Bank continue to grow their assets, expand their customer base, and invest in technology-driven banking services.

-

Effective Risk Management

Non-performing loans remain under control, and capital adequacy levels are strong across the leading banks.

-

Pan-African Expansion

UBA, Access Bank and First Bank lead in cross-border operations, making Nigerian banking influence felt in East, West, and Central Africa.

-

Digital Innovation

Nigerian banks are among the most technologically innovative on the continent, quickly adopting digital banking and fintech partnerships to improve customer experience.

Implications for Nigeria and Africa

- Boost for Investor Confidence

The strong performance of Nigerian banks reassures investors about the maturity and resilience of Nigeria’s financial sector.

- Strengthening Nigeria as a Financial Hub

The dominance of these banks positions Nigeria as a leading financial center in West Africa, attracting investment and partnerships.

- Setting a Benchmark for African Banking

Other African banks now look to Nigerian institutions for models of governance, growth strategy, and digital transformation.

- Need for Consistency

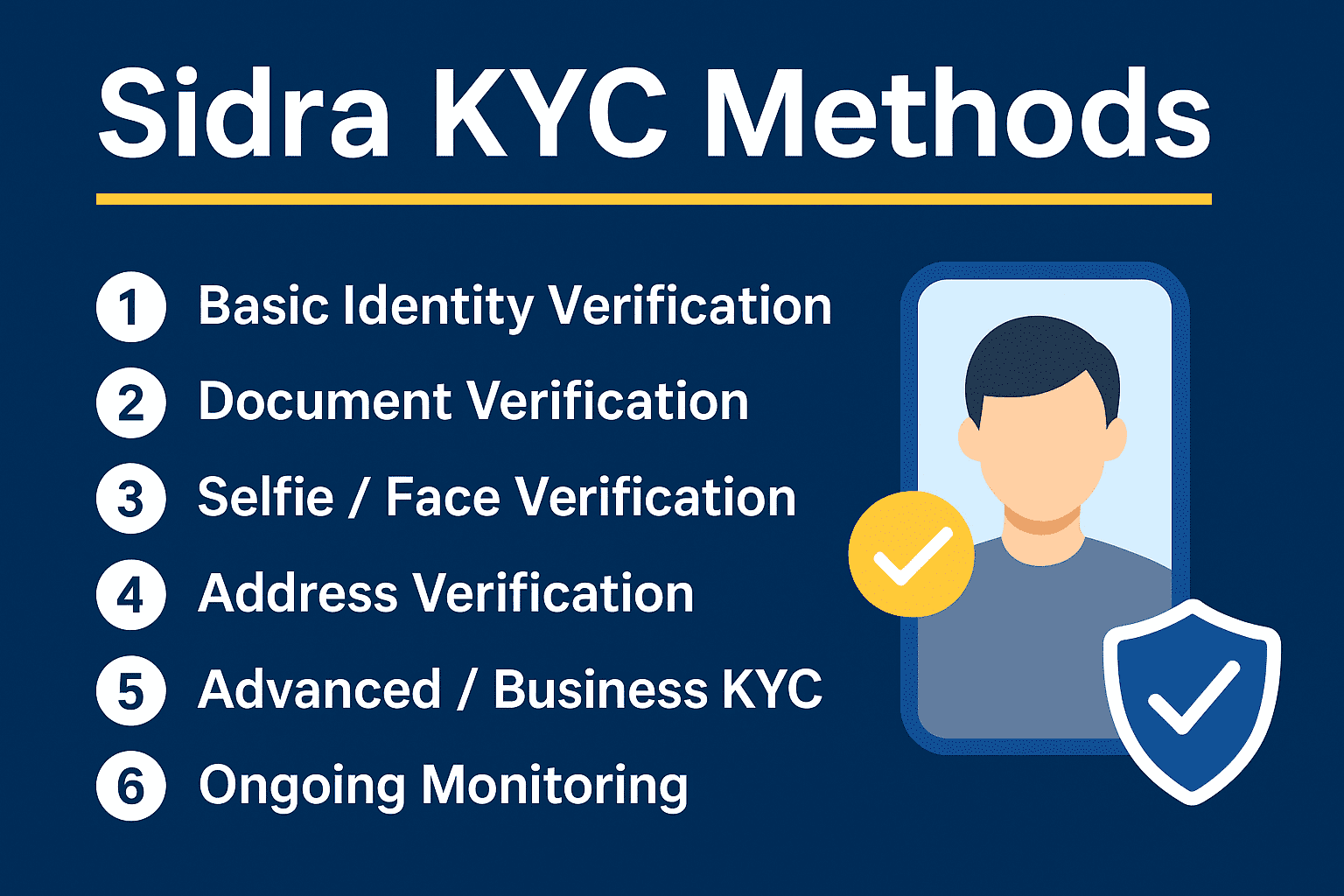

To sustain leadership, Nigerian banks must navigate economic challenges such as foreign exchange fluctuations, inflation, and evolving regulations.

Conclusion

Nigeria’s outstanding performance in the Africa’s 300 Finance Champions ranking showcases the nation’s banking strength, strategic thinking, and continental influence. By combining solid financial metrics with technological innovation and regional expansion, Nigerian banks continue to shape the future of African finance.

Their dominance is not just a win for the banking industry it is a significant boost for Nigeria’s economic reputation and a sign of greater opportunities across Africa’s financial landscape.