Manufacturers Association, Lagos Chamber, Others Hail Economic Reforms, Warn Growth Still Weak, Not Inclusive

Industry groups have said that Nigeria’s economic reforms are paying off in 2025, with a more stable naira, easing inflation, and improving business confidence. However, they have warned that growth remains too weak and not inclusive enough to lift incomes or reduce poverty in a meaningful way.

Nigeria’s 2025 macroeconomic narrative reflects a cautiously optimistic reset. The rebasing of key indicators, Gross Domestic Product (GDP) and the Consumer Price Index (CPI), alongside the gradual dissipation of disruptions from the mid-2023 structural reforms, supported improved growth momentum, exchange-rate stability, and firmer inflation anchoring. These headline improvements are signs of an economy jump-starting a new growth cycle following structural reform. However, rising fiscal constraints risk undermining this progress.

The Manufacturers Association of Nigeria (MAN), the Lagos Chamber of Commerce and Industry (LCCI) and the Centre for the Promotion of Private Enterprise (CPPE), while acknowledging significant macroeconomic gains from the reform drive, cautioned that structural bottlenecks, fiscal pressures and a challenging operating environment continue to limit productivity and broad-based prosperity.

MAN stated that “the modest yet consecutive rise in the MCCI since Q2 2025 reaffirms that Nigeria’s economy is on a path of gradual recovery. The stabilisation path has been cleared; what lies ahead is the imperative of accelerated growth. To sustain this trajectory, exchange rate stability must be guarded with every available policy tool. Currency stability is more than a macroeconomic metric; it is a reflection of national resolve.”

The president of Lagos Chamber of Commerce and Industry (LCCI), Engr. Leye Kupoluyi stated that “several landmark policy actions reshaped Nigeria’s economic landscape in 2025. The rebasing of GDP to 2019 and CPI to 2024 by the National Bureau of Statistics provided a more accurate picture of the economy, accurately reflecting the expanding digital sector, domestic refining, and structural shifts following the removal of subsidies.

Economic growth strengthened modestly, with GDP expanding by 3.98 per cent in Q3 2025, primarily driven by the services sector, which now accounts for over half of national output.”

He noted that Nigeria’s exit from the Financial Action Task Force (FATF) grey list marked a significant reputational and financial milestone, restoring confidence in the economic system and improving access to global capital.

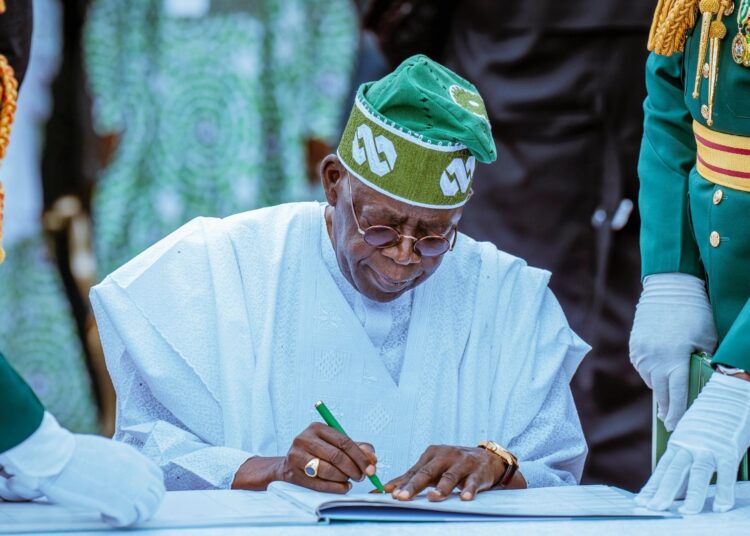

“Fiscal reforms also gained momentum with the signing of the Tax Reform Act in June 2025, which consolidated multiple tax laws into a unified framework set to take effect on January 1, 2026. On the real sector front, the expansion of domestic crude refining capacity, led by the Dangote Refinery, significantly reduced fuel import dependence, eased pressure on foreign exchange demand, and altered the inflation dynamic, even as competitive tensions reshaped the downstream petroleum market.

“Economic growth in 2025 showed only marginal improvement and remained insufficient to lift incomes or reduce poverty in a meaningful way. Average GDP growth of 3.78 per cent in the first three quarters of 2025 exceeded the 3.47 per cent recorded in 2024, with Q3 growth rising to 3.98 per cent. However, this performance remains below Nigeria’s population growth rate, underscoring that current growth is not inclusive and that the government must urgently address structural bottlenecks limiting productivity across key sectors,” he explained.

Kupoluyi disclosed that despite these reforms, Nigerian businesses suffered significant challenges that constrained growth and competitiveness in 2025 as nearly half of companies identified inflation as their greatest challenge; persistent FX volatility and earlier naira depreciation significantly increased import costs for raw materials and capital goods, complicating planning and weakening manufacturing and trade activities despite improvements in FX transparency; widespread insecurity, particularly in food-producing regions, disrupted supply chains, worsened food inflation, discouraged investment, and undermined rural economic activity; persistent power shortages, poor transport networks, and logistics inefficiencies raised operating costs and forced businesses to rely on expensive alternatives, limiting productivity; and inconsistent policies, multiple taxation, and regulatory unpredictability heightened uncertainty, constrained long-term investment decisions, and weakened the ease of doing business.

The chief executive officer of Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf added that “the year 2025 marked a significant turning point in Nigeria’s macroeconomic trajectory following the turbulence associated with the early phase of reforms.

“Exchange-rate stability emerged as the most visible achievement, with the naira largely trading within the N1, 440 and N1,500 per dollar band. Periodic marginal appreciation strengthened business confidence, eased imported inflation and restored predictability to pricing, contracting and investment planning.”

Yusuf stated that “inflation decelerated sharply from 24.48 per cent in January to about 14.45 per cent by November 2025. The slowdown was supported by currency stability, easing logistics pressures and improving supply conditions. Several food items and imported consumer goods recorded outright price declines, contributing to improved consumer sentiment and reduced price volatility.

“Business confidence strengthened materially. The NESG–Stanbic IBTC Business Confidence Index remained positive for most of the year, reflecting improved investor perception and a gradual recovery in corporate profitability. Many firms that posted losses in 2024 returned to profit in 2025, underscoring the stabilisation gains.”