How to Open a Wise Account: A Complete Step-by-Step Guide for Beginners

Opening a Wise account is one of the smartest decisions anyone who deals with international payments can make. Formerly known as TransferWise, Wise has grown into one of the world’s top financial technology platforms, offering cheap global transfers, multi-currency wallets, virtual cards, international bank details, and fast cross-border payments.

Whether you are a freelancer, remote worker, student, business owner, or online entrepreneur living in Nigeria or anywhere in the world, a Wise account can help you receive money seamlessly with some of the lowest transfer fees in the global market.

This guide explains how to open a Wise account step-by-step, required documents, verification steps, how to receive money, how to use the multi-currency account, and advanced tips to help you get the best out of Wise.

Let’s begin.

What Is Wise?

Wise is a global financial platform that allows users to:

-

Open a free multi-currency account

-

Hold and convert over 40 currencies

-

Receive money with international account details (USD, GBP, EUR, AUD, etc.)

-

Send money cheaply across borders

-

Use virtual and physical debit cards

-

Get paid like a local in many countries

-

Avoid the high fees of traditional banks

-

Wise is popular because of its transparency, low fees, and real exchange rates (mid-market rate).

Why You Should Open a Wise Account

Before creating your Wise account, it’s important to know why millions of people use it. Here are the top benefits:

1. Very Low Transfer Fees

Wise charges some of the lowest international transfer fees in the industry, often 3–8x cheaper than banks and PayPal.

2. Real Exchange Rate

Wise uses the exact rate you see on Google or XE — without hidden markups.

3. Multi-Currency Wallet

You can hold multiple currencies at once (USD, EUR, GBP, CAD, AUD, NGN, etc.).

4. Receive Money from Anywhere

You can receive international payments like a local using free bank details.

5. Supports Freelancers and Remote Workers

Platforms like Upwork, Fiverr, Payoneer, Deel, and foreign employers trust Wise.

6. Virtual Debit Card

Wise gives you a virtual card for online payments, subscriptions, and purchases.

7. Business Accounts Available

You can open a Wise Business account to receive payments and make invoices.

Requirements to Open a Wise Account

The process is simple. Here’s what you need:

-

A valid email address

-

Phone number

-

A smartphone or computer

-

A valid ID for verification:

International passport

-

National ID card

-

Driver’s license

5. Residential address

6. A document for address verification (sometimes required):

-

Utility bill

-

Bank statement

-

Tax document

Once you have these ready, you can open your Wise account in under 10 minutes.

How to Open a Wise Account Step-by-Step

Below is a complete walkthrough.

Step 1: Visit Wise Website or Download the App

- Go to: www.wise.com Or download the Wise mobile app on Android or iOS.

- Click on “Register” or “Create Account.”

Step 2: Choose Your Account Type

Wise offers two types:

1. Personal Account

- For sending/receiving money, personal use, shopping, subscriptions, freelancing.

2. Business Account

- For companies, small businesses, online stores, and freelancers who want invoices.

- If you’re a freelancer or remote worker, a personal account is usually enough, but business accounts have more professional features.

- Select your preferred account type.

Step 3: Enter Your Email Address

Wise will ask for a valid email. Enter your email and click Next.

You can also sign up using your:

-

Google account

-

Apple ID

-

Facebook account

-

But using email is simpler.

Step 4: Create a Secure Password

Choose a strong password containing:

-

Letters

-

Symbols

-

Numbers

-

This keeps your account secure.

Step 5: Enter Your Country and Phone Number

- Choose your country of residence (e.g., Nigeria).

- Enter your phone number to receive a verification code.

- Once the code is sent to your phone, enter it into the verification box.

Step 6: Provide Your Personal Details

Wise will ask for:

-

Full name (must match your ID)

-

Date of birth

-

Residential address

-

Nationality

-

Ensure your details are accurate they must match your ID document during verification.

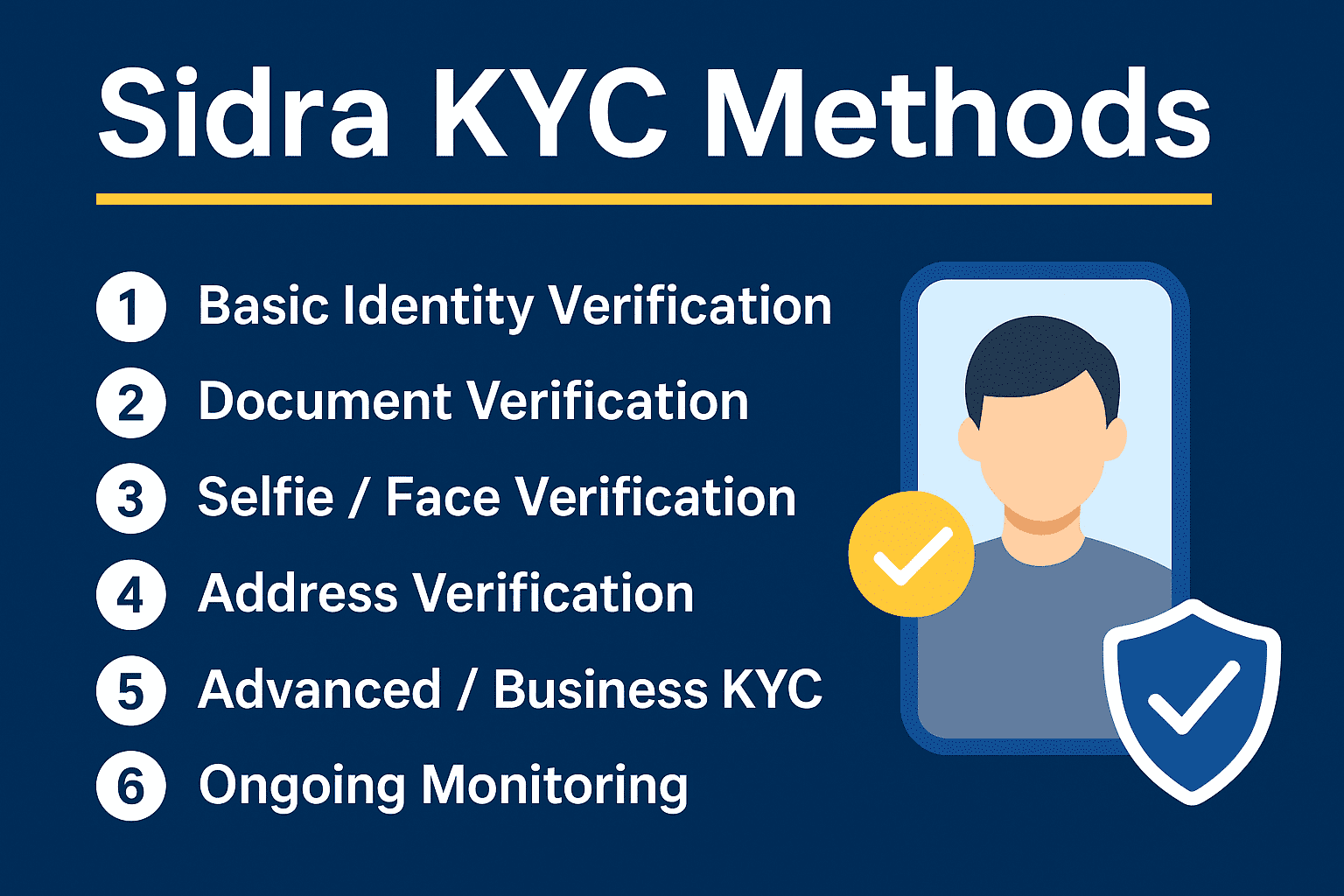

Step 7: Complete Identity Verification

Wise requires ID verification to keep your account safe and meet global regulations.

Upload one of the following:

-

National ID card

-

International Passport

-

Driver’s License

You will also be asked to take a selfie to match with your ID.

Verification Time:

Normally takes between:

- 5 minutes to 24 hours,

depending on the country and time of submission. - Once approved, your account becomes fully active.

How to Add Money to Your Wise Account

To start using Wise, you may need to add funds.

You can add money via:

-

Debit card

-

Bank transfer

-

Credit card

-

Other Wise users

-

Local transfer (in supported countries)

-

Wise will show you the exact fee before you confirm.

How to Receive Money with Your Wise Account

One of the best features of Wise is the ability to get local bank account details in multiple countries.

Once verification is complete, you can receive money like a local using:

US Account Details (ACH + Wire)

- Routing Number

- Account Number

UK Account Details (Sort Code + Account Number)

-

Eurozone Account (IBAN)

-

Australian Account Details

-

Canadian Account Details

-

…and many more.

These account details allow you to receive payments from:

-

Upwork

-

Fiverr

-

Payoneer

-

Employers abroad

-

Clients

-

International banks

-

Dollar apps

-

Companies in the US, UK, or EU

Receiving money with Wise is fast most transfers arrive within minutes to hours.

How to Send Money with Wise

Sending money is simple:

1. Log in to your account

2. Click Send Money

3. Enter recipient’s bank details or email

4. Choose the currency

5. Confirm the transfer

6. Pay using your Wise balance or card

Wise will show the:

-

Transfer fee

-

Delivery time

-

Exchange rate

-

before finalizing the transfer.

How to Use Wise Debit Card (Virtual & Physical)

Wise offers both:

1. Virtual Debit Card

Instantly available after verification.

You can use it for:

-

Online shopping

-

Digital subscriptions

-

Paying on foreign websites

-

Verifying accounts

-

Booking hotels & travel

2. Physical Debit Card

- Can be ordered and shipped to countries where Wise cards are supported.

- Wise for Freelancers and Remote Workers

- If you work online, Wise is one of the best payment solutions.

Platforms that support Wise:

-

Upwork

-

Fiverr

-

Toptal

-

Deel

-

Payoneer (indirectly)

-

International clients

-

Remote companies

Wise helps you avoid high bank fees and slow transfers.

Wise Business Account Features

Business users get access to:

-

Invoice payments

-

Bulk payments

-

Accounting integrations

-

International receiving accounts

-

Team member access

-

Multi-currency balance

-

VAT payments

-

Perfect for SMEs and online businesses.

Is Wise Available in Nigeria?

Yes — Wise works in Nigeria.

You can:

-

Open a Wise account

-

Receive money from abroad

-

Hold USD, GBP, EUR

-

Convert funds

-

Send money to international accounts

However, sending money from Nigeria to other countries may be limited due to CBN regulations. But receiving money works 100%.

Common Problems When Opening a Wise Account (and Solutions)

1. Verification Failed

Make sure:

-

Your ID is clear

-

Your selfie matches your ID

-

Your name matches your documents

2. Address Not Accepted

Use documents with your correct address:

-

Utility bill

-

Bank statement

-

Tax bill

3. Wise Asking for Additional Documents

Sometimes Wise requests extra documents for security simply upload them.

Tips to Get the Best Out of Your Wise Account

-

Always use your real information

Wise is strict about identity verification.

- Keep transactions within Wise rules

Avoid suspicious payments or crypto-related transfers.

-

Enable two-factor authentication

Protect your account.

-

Store money in multiple currencies

Useful for freelancers and travelers.

-

Use the virtual card for online security

Especially for online subscriptions.

Conclusion

Opening a Wise account is fast, easy, and highly beneficial. Whether you are a freelancer receiving international payments, a business owner handling cross-border transactions, or someone who simply wants a reliable platform for sending and receiving money globally, Wise is one of the best solutions.

With simple verification, low fees, and transparent currency conversion, Wise gives you full control over your international finances.

If you follow this guide step-by-step, you will have your fully verified Wise account within minutes and can start enjoying all its features.